AdTech and Martech converged in Cannes last week. It’s a foreshadowing of what’s to come. As Larry Allen VP and GM of Enablement and Addressable Audiences at Comcast said on the Croisette, “The biggest trends in advertising right now are the move to advanced audiences and the use of deterministic first-party data.” Advertising is of course a pressing use case for first-party data but it’s not the only one. And that data lives in the Cloud.

A year ago blogged about this convergence or “Singularity” as I called it then. A year later I thought this idea might be worth an update. At the risk of losing all humility let’s start with some words from that post.

“Convergence of AdTech and Martech is a data story. A first-party data story.”

AdTech right now is focused on an idea called “The Logged-in Internet” which is rising in consumer popularity. “Logged-In” is of course euphemism for first-party data collection and identifiers. It’s the TOS contract of your data and ID in exchange for goods and services. It is a concept as old as magazine subscriptions and catalog commerce. If you don’t log-in, there is no media. If you buy from us, we know who you are. It is generally a good trade-off because it places a premium on quality and relevance for the consumer. Not something AdTech has cared much about the past 20 years.

Contrasting this is the “Open-Internet” that has historically relied on 3rd party data to function. This has been the bread-and-butter data for AdTech for decades. Data was acquired without permission and then passed around through a daisy-chain of interested parties. With 3rd party data collection cookies and ID tracking being eliminated by browsers and CDN/DNS, the AdTech industry is concerned about the ability of Open-Internet advertising to operate. Rightfully so. Anonymous people are worth very little to advertisers and marketers on the Internet.

“The Open Internet” is trying to come up with a way to keep whatever value their media once had. Overflowing these sites with ad units and making them primarily for advertising and AI created content is one way. Another way is impression generating bots. They make up a significant portion of what “The Open Internet” is selling — as anyone who has seen traffic logs from these sites knows.

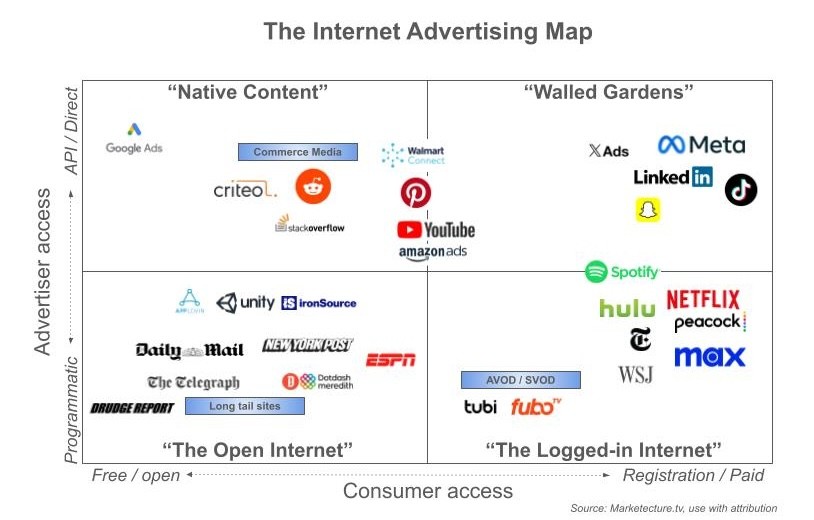

Here is a nice 2×2 industry luminary Ari Paparo created around what’s happening now and how it relates Digital Advertising:

While I don’t agree with everything here – ESPN/Disney, Amazon on YouTube I think should be more towards logged-in, Ari has laid out well the bifurcations happening in media. His original post is here where he lays out in more detail why “The Open Internet” is in trouble.

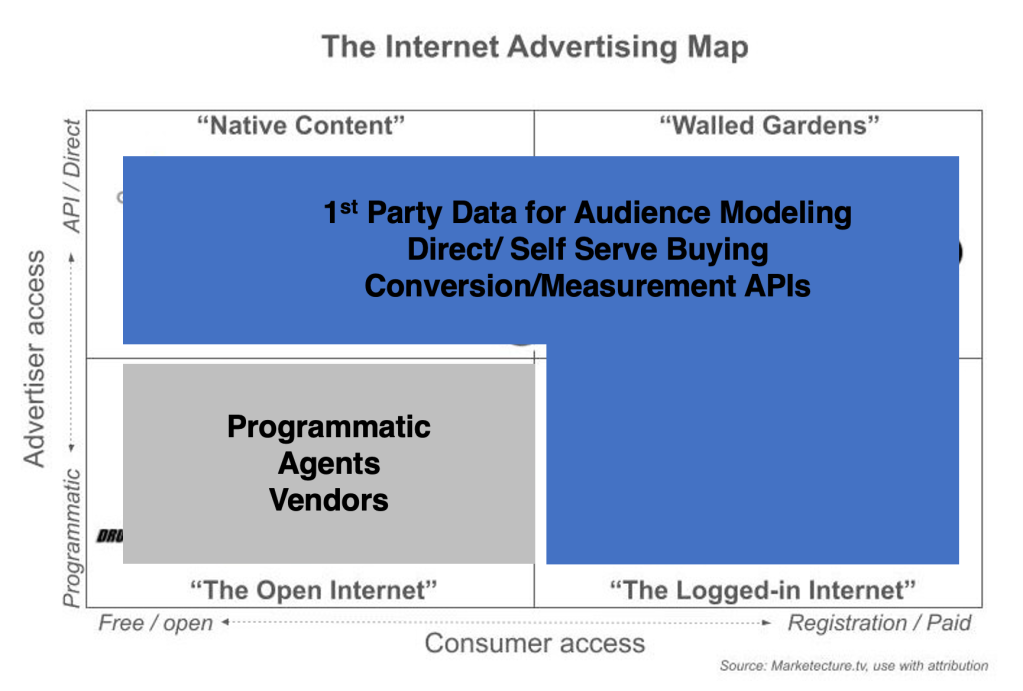

Besides the identity the Native, Walled, Logged-In and Open also can be viewed in another framework related to workflow and operations that is also highly differentiated (notations my own):

This growing dichotomy between the 1P data haves and have-nots was on full display earlier in the month ahead of Cannes.

People involved in “The Open-Internet” were at NY Tech Week speaking on panels about the demise of the cookie and what is going to replace it (just like they did at Cannes). Right now, the answer coming from them, or at least the largest company in the space The Trade Desk, seems to be “quality supply.”

Meanwhile that same week across the country in San Francisco those holding the first-party data of the “Logged-in Internet” were talking about how collect and use first party data to grow their businesses at Snowflake Summit.

Hailstorm of the Data Cloud

I happened to be presenting at Snowflake Summit. The show was impressive. Snowflake has some massive global media companies that store and compute their first-party data with them. They have a significant Agency footprint as well and are deeply partnered with consultants with Slalom, EY Accenture and Deloitte having prominent roles at the show.

In all there are over 160 tech partners in the Snowflake ecosystem many who count a multitude of brands (and their data) as customers. This doesn’t include marketplace partnerships with companies like LiveRamp and Acxiom. It’s also worth accounting for Snowflake’s own products including the clean room technology Samooha purchased last year that was founded/built by the team that founded AdTech company Drawbridge. Clean rooms are where first-party data from different companies can be matched and modeled in a privacy ensuring manner.

To top it all off, convergence of AdTech and Martech in the Snowflake cloud is likely in good hands. 16-year Google Engineering veteran and former Google Advertising Czar Sridhar Ramaswamy was named their new CEO earlier this year.

Of course, first party data and AdTech<>Martech convergence is much larger than just Snowflake. It’s the entirety of Cloud. This is due to data privacy and data security/ownership/governance but also because scaled data movement, synchronization and collaboration are main use-cases of Cloud. It’s why AdTech was built on Cloud in the first place.

AdTech has long been “composable” (the current term du jour for Martech). Ad campaigns can and do run across different partners for media buying, selling, data, measurement, and verification. What’s been missing is data transparency and an operating system that relied on servers instead of the browser.

Buyers and the sellers of media have been taxed by middlemen that have slowly captured more of the margins for themselves. Many in the industry refer to this as the “AdTech tax.” As convergence happens this tax will get further and further reduced through direct APIs and data transparency. One example coming out of Cannes is the announcement of Header Bidding server deployment now available in AWS VPC. In fact, AWS goes as far as to call these services “Transparent Ad Marketplace.”

Like all major shifts this Singularity is not some large one-time event. This event has been happening over the past 5 years and likely will take another 5 to complete. A great example of this progression is the Customer Data Platform (CDP) space. Maybe the last of the big SaaS Martech categories to emerge from VCs during the ZIRP, legacy CDPs have been forced by their customers to move from hosted solutions that stored first-party customer data in the vendors database to composable solutions that zero-copy data into the customer’s cloud. In addition to new technical requirements for legacy CDPs they faced a slew of new competitors with names like Hightouch, Census and Rudderstack that were built to work natively with cloud data warehouses from day 1.

Legacy CDPs have all navigated this move well – at the end of the day it’s just and API – but returns VCs had hoped for from this category circa 2020 when Segment was purchased for $3.2B have vanished along with the rest of the SaaS category as it gets eaten by the Cloud and AI. Your margin is the cloud’s opportunity.

On Snowflake’s part they long ago announced the ability to move data back and forth from Adobe and have only added partners including recent announcement of an expanded partnership and enhanced interoperability with Azure/Microsoft Fabric. Databricks also recently announced a partnership with Adobe for “Federated Audience” and just last week laid out slew of partners like The Trade Desk, Acxiom and LiveRamp in their Delta Sharing. “Sharing” being the operative word about these cloud partnerships.

Last but not least, Google Cloud often thought of by many as the highest of walled data gardens and generally the Cloud that AdTech people have the most issues with is also working on data movement. A few weeks ago Ritika Suri, Director, Data and AI Technology Partnerships at Google Cloud said;

“Google Cloud is committed to fostering an open and interoperable data ecosystem”

The walled data gardens are building tunnels. Well actually they are called “lakes” but you get the idea.

Crashing the First Party

If Cannes is the world-party of Advertising, each year the party gets crashed more and more by data nerds. This year again there was AWS, Adobe, Snowflake, Salesforce and Google Cloud. Even the big consultancies like BCG, Bain and PwC were there. Snowflake told me their presence in Cannes has quadrupled in the past 4 years. They are there because their Media & Entertainment and Agency customers are there. Everyone there has data in the Cloud. The whole media/advertising/commerce thing runs on data and soon it will only run on first-party data.

Measurement is of course one of the pressing issues of advertising since its dawn as John Wanamaker famously alluded to. So it’s no surprise this past year saw the growth integrations in the Cloud for data activations and measurement.

Conversion APIs (CAPIs) or as Meta told me recently, “please call it platform reporting” is all the rage. Not only is first-party data being collected, organized, and activated from the Cloud. It’s being closed-looped for measurement and modeling. This is the part I’m not sure people understand the impact enough.

There is no future world where I drop javascript tags and give a vendor data to store and use. There is no more SaaS as we knew it. There is no more data being processed outside my warehouse. Not for marketing, not for advertising. Not for reporting. Not for measurement. Not for anything except server-to-server targeting and even then, those are just IDs for matching. Attributes about those customers/audience IDs stays with the first-party.

This extends from Paid Media into Owned Media where website and app personalization to improve conversion rate is the dominant use-case. Over the last year leading data collectors like Snowplow and Amplitude have made themselves available as fully native applications in the Cloud. This is to say nothing of Google Analytics and BigQuery that are now joined at the hip. The data warehouse is the center of gravity for all this first-party behavioral data.

On the flip side data activation companies like Hightouch, Growth Loop and Census have made activation from the cloud easy across hundreds of destinations including email and SMS tools like Braze and Attentive. There’s no data collection, organization, activation, and measurement that can’t be done from and in a brand’s private cloud. This means we’ll likely see the trend of brands in-housing marketing and advertising services continue as well.

Despite the rise of in-housing, Agencies have an interesting role to play in the convergence. They have control over a lot of data. They have built their own planning & buying as well as audiences and identity systems on top of this data. Those investments have consolidated recently as losses of 3rd party data weaken these signals. However, being the steward of 1st party data is its own opportunity. If they can show ROI many brands will always want to outsource these functions.

At Snowflake Summit I presented in a session with Power Digital. They have long been a well-respected performance agency. They understand what is possible with the high-fidelity signals from first-party data and have invested in building a really cool platform they call Nova. They are not alone moving in this direction.

The wild card for agencies is Clean Room and other API-based data matching and activation. Back in the day, Ad Networks being walled data gardens themselves were able to compete with platform algos on performance. But impression-based bidding and CPM pricing most agencies eat off does not drive the same decision intelligence as CAC and CPC buying and bidding. Ad networks died because agencies wanted media margins instead of efficiency and performance. It will be interesting to watch how Agencies adapt now when the data to deliver intelligence is sitting in someone else’s Cloud.

The End of the Beginning

The most interesting and exciting part of this convergence (at least to me) is the opportunity for AI. AI is a force multiplier for first-party data. The walled gardens of Meta and Google have been so far ahead in Paid Media performance because of their vast quantities of first-party data and O&O media compared to the of 3rd party data and media that have been the main inputs for Machine Learning in AdTech. Owned Media has had its own issues with ML using first-party data. Conversion rates have been stuck at 3% for so long because that data has been siloed in different Martech point solutions and segmentation in these tools is done with SQL joins instead of the deep learning Meta and Google have built.

AI thrives with large amounts of unstructured high-fidelity data. Being able to access data across paid and owned media channels and the full customer lifecycles is just what AI needs. These tables are becoming more and more prevalent in the cloud as data teams and CDPs are working on aggregating some flavor of what has been come to be called a “Customer360.” This is a major unlock for AI.

With media assets also stored in databases and server-to-server available for every part of the workflow it will not be long before cloud specific agentive AI will tag, activate, track and report on campaigns. This is all API driven, containerized in the Cloud with total audibility. In fact, my company Neuralift AI is already working with a company called Genesis Computing to do agentive marketing AI from Snowflake. To paraphrase Gibson, the future is here, it’s just unevenly distributed.

AdTech and Martech are converging. There are new walled gardens being built in each Cloud. They operate as all walled gardens do — on 1st party data. That data is collected, stored, enriched, processed, shared, activated, and measured in and across clouds. It’s closed loop. It’s private. It’s scalable. And it will all get better and smarter over time with AI.

A year after I first wrote about “Singularity” we can now clearly see AdTech and Martech convergence is well underway. Welcome to the platforming of first-party data! It’s the endpoint.

Leave a comment